Tax Incentives In Developing Countries And International Taxation

[PDF] Tax Incentives In Developing Countries And International Taxation Ebook

Tax Treaties And Developing Countries Series On

Income Tax Incentives for Investment - olc.worldbank.org Tax Law Design and Drafting (volume 2; International Monetary Fund: 1998; Victor Thuronyi, ed.) Chapter 23, Income Tax Incentives for Investment - 1 - 23 Income Tax Incentives for Investment David Holland and Richard J. Vann1 To lay, with one hand, the power of the government on the property of the citizen, and with the other to (PDF) International Tax Competition and Tax Incentives in ... PDF Elisabeth Gugl and others published International Tax Competition and Tax Incentives in Developing Countries Corporate Tax Incentives and 3 FDI in Developing Countries CoRpoRate tax InCentIves and FdI In developI CountnG RIes 75 While tax incentives are common in developing countries, they vary at the sector, regional, and income levels. Across sectors, 4972 percent of all developing countries offer tax holidays, preferential or very low general tax rates, or tax allowances. Tax incentives are

Research And Development Tax Incentives Federal State

International Tax Competition And Tax Incentives In

Global Human Resources Management Ppt Video Online Download

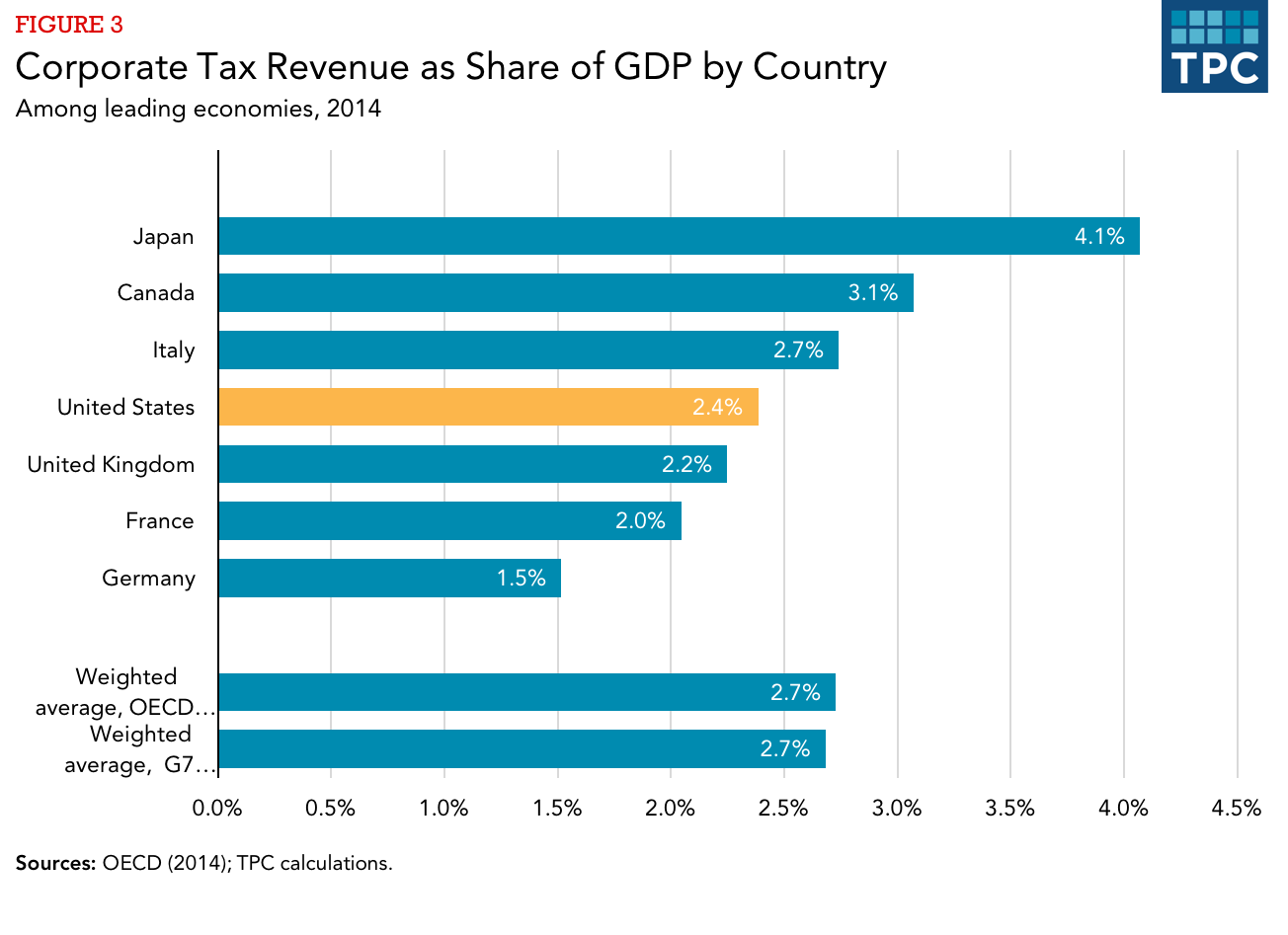

How Does The Current System Of International Taxation Work

0 Response to "Tax Incentives In Developing Countries And International Taxation"

Post a Comment